Tungsten Printix: Secure Cloud Print Management for SAP®

Streamline Your SAP® Printing with Verbella & Tungsten Printix

At Verbella, we understand the critical role printing continues to play in your business processes—from invoices and quotes to labels and annual reports. As a premier partner of Tungsten Automation (formerly Kofax), Verbella offers Tungsten Printix, a robust and secure cloud-based Output Management Solution (OMS) designed specifically for SAP® systems.

Why Choose Tungsten Printix?

-

Serverless Cloud Printing: Eliminate on-premises print servers, significantly reducing infrastructure costs and complexity.

-

Flexibility and Scalability: Manage printers, drivers, and queues centrally from the cloud, suitable for businesses of all sizes, from small businesses to large enterprise organizations.

-

Enhanced Productivity: Enable users to print securely from any device, at any time, to any printer using both Direct Print and Print Anywhere functionalities.

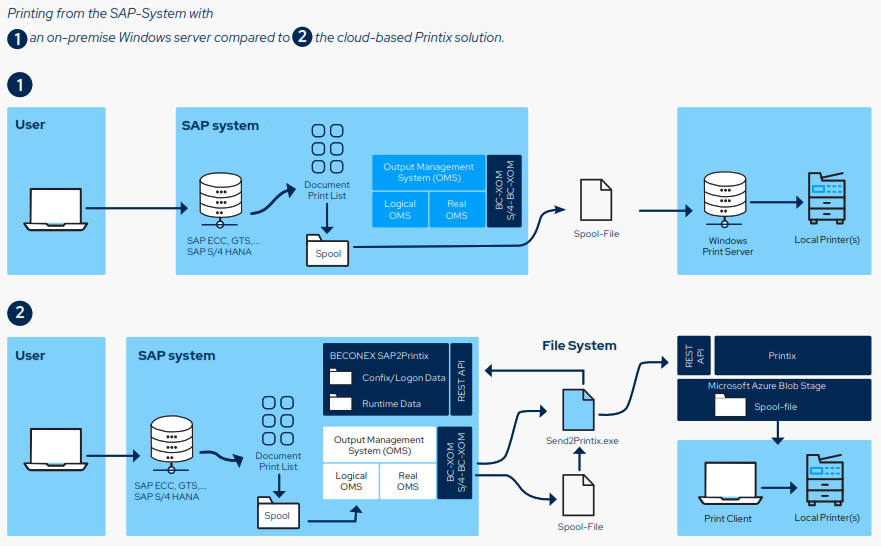

SAP® Integration with BECONEX SAP2Printix

Verbella integrates the advanced BECONEX SAP2Printix software, specifically designed to enable seamless cloud print management directly from SAP®. BECONEX SAP2Printix integrates effortlessly with your existing SAP® environments, providing a secure and efficient way to transition your printing processes fully to the cloud.

Key features of BECONEX SAP2Printix:

-

Direct Integration: Connects directly with SAP® ABAP NetWeaver, SAP ECC, GTS, EWM, SRM, and SAP S/4HANA® On-Prem and Enterprise Cloud systems.

-

Simple Setup and Customization: Easy registration of Printix tenants, straightforward SAP printer configuration, and user-friendly customization directly within your SAP system.

-

Centralized Management: Provides comprehensive monitoring and logging of print job parameters, REST calls, and responses between SAP, BECONEX SAP2Printix, and Printix.

-

Direct Print and Print Anywhere: Offers users two convenient printing options:

-

Direct Print: Immediate printer selection and printing.

-

Print Anywhere: Users can send print jobs to the cloud and select their preferred printer later using a mobile app or authentication card.

-

Figure: Comparison of printing workflows from SAP®—traditional on-premises Windows server vs. cloud-based Tungsten Printix solution.

Experience the Benefits

-

Cost Efficiency: Significantly reduce local printing expenses and administrative overhead.

-

Rapid Deployment: Quickly configure your SAP2Printix environment with minimal technical effort.

-

Advanced Monitoring: Gain real-time insights into all SAP spool requests and print job statuses.

Secure, Efficient, and Reliable

With Tungsten Printix and BECONEX SAP2Printix, Verbella ensures your SAP® output processes are robust, efficient, and scalable to meet your evolving business needs.

Ready to Transform Your SAP® Print Management?

Contact Verbella today for a personalized consultation and see firsthand how our expertise with SAP® and Tungsten Automation can transform your print management strategy.